Rate capping – what the Government didn’t tell you

While most Victorian councils have confirmed their intention to not raise rates above the State’s 2.5 per cent rate cap from 1 July, the Government hasn’t been upfront about how individual ratepayers will be impacted.

Cr Bill McArthur, President of the Municipal Association of Victoria (MAV) said the rate cap applied to the total overall rate revenue collected by a council - but will not apply evenly to every individual rates notice - and the Minister excluded some charges and levies from the cap.

"Only six councils were granted approval by the Essential Services Commission to raise rates above the cap, with the remaining 73 councils required to comply.

"Of immediate concern to councils is how the Government ‘sold’ its populist policy to the community and what they haven’t adequately explained to ratepayers.

"We believe the majority of people will feel misled by the Government when they receive their rates notice, even though most councils will be complying with the 2.5 per cent rate cap.

"The Government's 'fair go' rates as they've called it has led many community members to believe their rates notice will not be more than 2.5 per cent higher than it was last year.

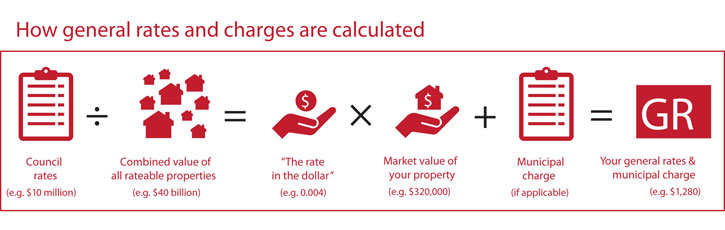

"However, 2016 is a property revaluation year and all Victorian properties were revalued as at 1 January. Rates paid by individuals will depend on their new property valuation relative to other properties within their municipality.

"Some ratepayers will pay less than the 2.5 per cent cap and others will pay significantly more, but the overall rates collected by a council won't exceed the rate cap, unless they were granted an exemption from the cap.

"It's a common misunderstanding that as property values rise, councils collect more money overall, but they don't. Higher property values only change how much each property owner pays towards the total council rate revenue, which must stay within the State’s rate cap.

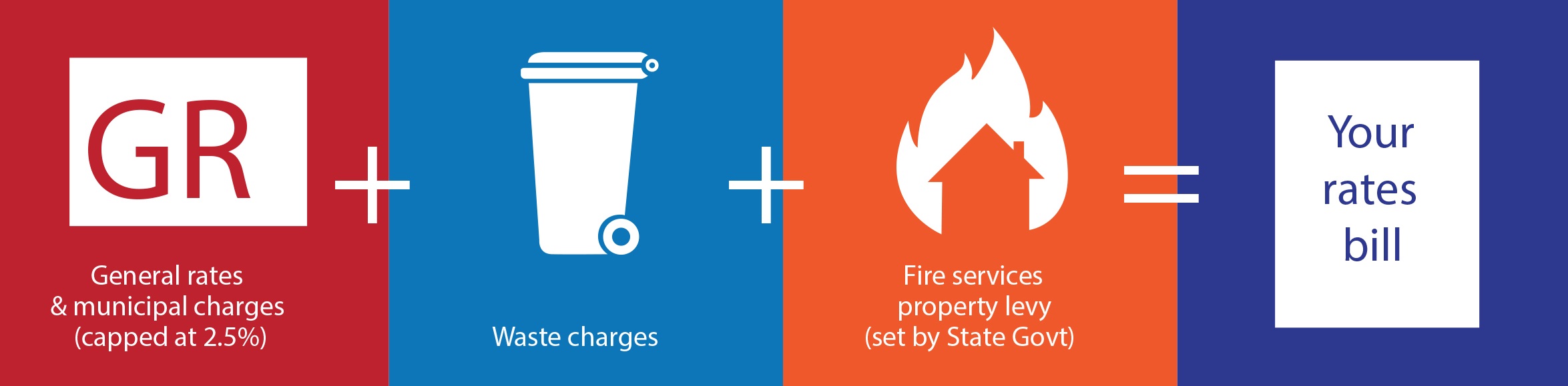

"The rate cap also doesn't apply to council waste charges or the fire services property levy, which councils collect and pass on to the State Government to fund Victoria's fire services agencies.

"Councils have been innovative in finding ways to reduce their costs. Some have undertaken internal reviews and organisation restructures, committed to sharing services with other councils, cut back local grant opportunities, and reduced some service hours in consultation with communities," he said.

The biggest hidden consequence of rate capping will be the cost to future generations of ratepayers as councils are unable to invest enough to adequately maintain and renew their local infrastructure.

Cr McArthur said that local government was responsible for $79 billion worth of roads, drains, footpaths, town halls, parks and countless other community facilities, and the long-term repercussion of under-investment was future ratepayers facing much higher costs to replace run down assets.

"Many councils now feel abandoned by the State, which has left them with the task of explaining and defending a State policy that used a catchy slogan to sell voters a complex, misunderstood beast," he said.

Note: Two-yearly revaluations assist in delivering rating equity by sharing the rates within a municipality according to property price movements. The Valuer General Victoria independently oversees the valuation process and certifies that a council’s general valuation complies with required standards and statutory rules.

– Ends –

For further information contact MAV President, Cr Bill McArthur on 0437 984 793 or the MAV Communications Unit on (03) 9667 5521.